Donor-advised funds: Bunching, abundance, and flexibility

Many people establish a donor-advised fund at the FM Area Foundation to simplify their giving, stay organized, and even engage

Many people establish a donor-advised fund at the FM Area Foundation to simplify their giving, stay organized, and even engage

With only a few months left in 2025, it is important to evaluate your philanthropy sooner rather than later. Recently

We’ve rounded the corner into the fourth quarter! As the calendar year draws to a close, you’re likely well aware

Remember the good old days when your clients could withdraw the money they inherited in their parents’ IRAs over the

For many attorneys, financial advisors, and CPAs, estate planning is part of your client conversations every single month, week, and

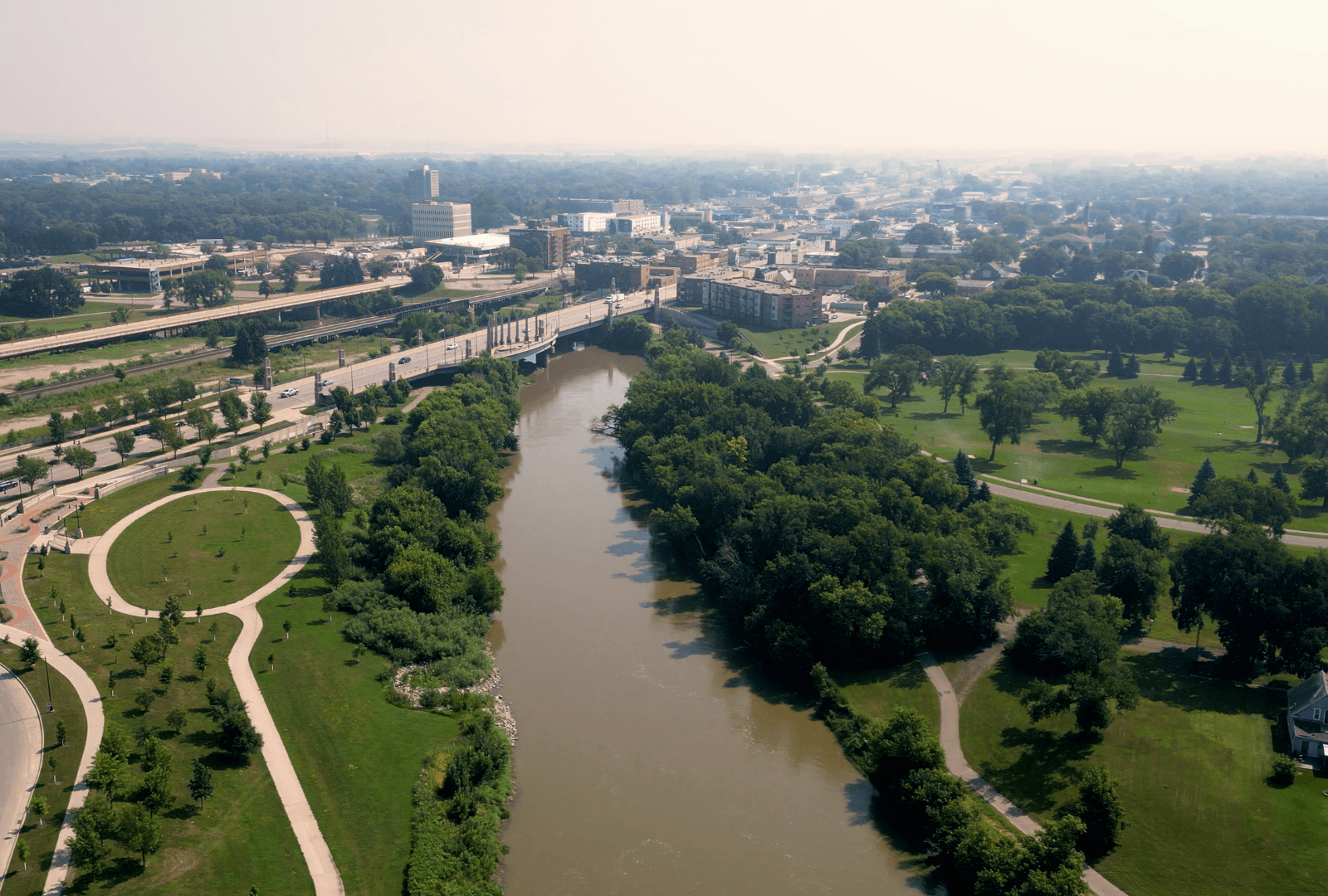

In an economic and legislative environment full of unpredictability, we encourage you to tap the knowledgeable team at the FM Area

It’s more important than ever to stay informed about how changes in the tax law may affect your charitable giving.

Featured Speaker: Bryan Clontz Bryan is the founder and President of Charitable Solutions, LLC, specializing in non-cash asset receipt and

If you’ve noticed a surprising uptick in recent years among your younger clients investing in artwork, it is not your

At the FM Area Foundation, we’re dedicated to helping your clients achieve their charitable goals. We’re honored to serve as