Clean slate: Tips for charitable giving in 2024

A new year is such a great time to plan and reboot. Cliche as it may be to talk about resolutions this time of year, it’s tough to deny that January represents a clean slate for “to-do” lists, goals, and your overall mindset. As you think about your 2024 charitable giving goals and priorities, here […]

Philanthropy keeps your clients sticky

Retaining your clients or customers is the key to success regardless of your business or industry. As the saying goes, it’s easier and less costly to retain or get more work from a current client than it is to find a new client. As an attorney, accountant, or financial advisor who helps clients with […]

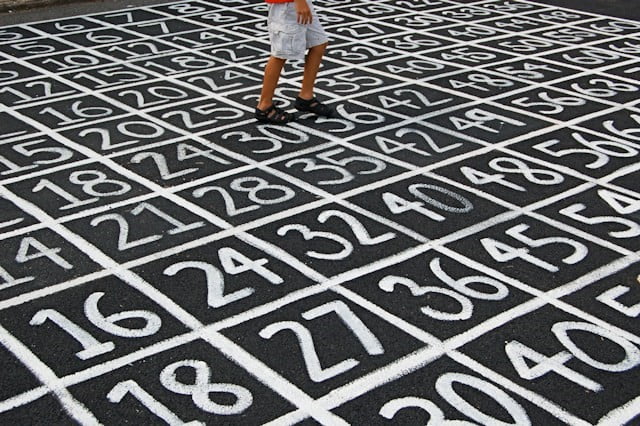

By the numbers: What’s around the corner in 2024

As 2023 makes way for 2024, you’re no doubt inundated with information about the various IRS thresholds that are subject to adjustment. But have you thought about how each of these thresholds might be connected with your client’s charitable giving? Here are a few pointers to keep handy as you inform your clients about changes […]

Charitable giving tips for clients’ golden years

The rising popularity of the Qualified Charitable Deduction–”QCD”–appears to be inspiring an increasing number of retirees to re-evaluate their charitable giving plans. Before the clock winds down on 2023 giving opportunities, be sure you’re familiar with the various charitable giving techniques that are most appealing to retirees and the various ways the FM Area Foundation […]

Crisis giving: Avoiding pitfalls

Whether you’re motivated to respond to needs created by a conflict, accident, or natural disaster, it’s human nature to want to help—especially through financial support. All too often, a tragic event occurs and is quickly publicized through news accounts or social media. Then, the dollars start rolling into a crowdfunding site like GoFundMe, Kickstarter, or […]

Get ahead of the year-end rush

Holidays and tax planning (although very different in the ways they are celebrated!) are both year-end traditions. No doubt (?) you’ve got the holidays covered, and perhaps your advisors are already helping you make sure your tax planning is in place. It’s a good idea to familiarize yourself with several important year-end charitable giving techniques […]

Charitable planning and women clients: Three mini-case studies

Women’s spending power has been in the news over the last several weeks as Taylor Swift’s and Beyonce’s tours continue to break records, and the Barbie movie still looms large. As you’ve worked with female clients over the years, you’ve likely noticed a few trends: Women frequently take on caregiving roles within a family, including caring for both their parents and […]

Spotting opportunity: Moving from a commercial fund to the FM Area Foundation

Although a donor-advised fund, which is becoming a more and more popular charitable planning tool, can be established through a national financial institution, the community foundation offers its donor-advised fund holders much broader services, more personal attention, and deeper connections to the nonprofits whose work is essential to effect positive community change. Unfortunately, many attorneys, […]

Clients want to know: What’s deductible and what’s not?

Whether you are an estate planning attorney, financial advisor, or accountant, you’ve probably seen an uptick in client questions about tax deductions–and tax rules in general–over the last few years. Tax law changes at the end of 2017 have caused much ongoing taxpayer confusion. To be sure, your clients will be asking about charitable tax deductions […]

Relief from catch-up requirements: More money for charitable giving?

Legislation known as SECURE 2.0 contained a dizzying array of changes to the laws governing retirement plans. Passed at the end of 2022, SECURE 2.0 is 130 pages long; overall, its purpose is to encourage more retirement savings through vehicles like employer-sponsored 401(k) plans. Lately, the buzz around SECURE 2.0 has been focused on a […]