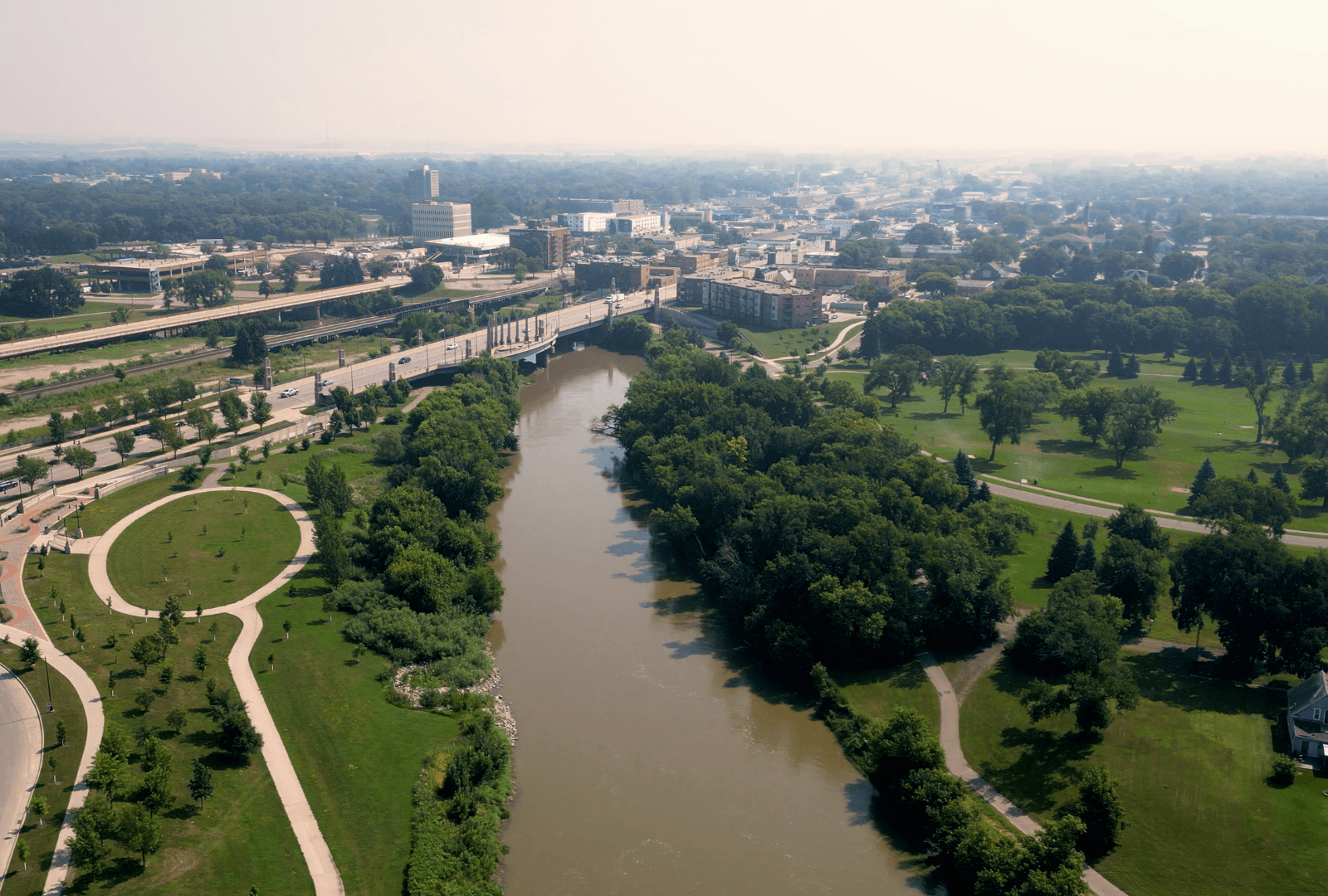

Planning for clients’ incapacity: Why charitable intentions matter

The team at the FM Area Foundation is honored to work with attorneys, CPAs, and financial advisors to help clients turn generosity into lasting impact. Of course, as you work with your charitable clients, you routinely determine the best way to incorporate philanthropic intentions into wills, trusts, and beneficiary designations. But how frequently do you […]

A key to client retention: Consider charitable planning

Retaining clients is a cornerstone of long-term business success, no matter the profession or industry. As the saying goes, keeping an existing client—and earning additional work from that client—is far easier and more cost-effective than securing a new client. For professionals who work in estate, tax, and financial planning, this principle becomes especially important during […]

2025 action required: Last call for current tax rules

As you counsel clients through year-end tax planning, the FM Area Foundation encourages you to remind them that 2025 presents a critical window of opportunity for charitable giving before major provisions of the One Big Beautiful Bill Act (OBBBA) take effect on January 1, 2026. The new law could significantly reshape the tax treatment of […]

Donor-advised funds: Bunching, abundance, and flexibility

Many people establish a donor-advised fund at the FM Area Foundation to simplify their giving, stay organized, and even engage the next generation in philanthropy. And, for some families, 2025 is the year when the donor-advised fund takes on an even bigger role in aligning charitable giving goals with changing tax laws. Even families who […]

Six tips for your year-end game plan

With only a few months left in 2025, it is important to evaluate your philanthropy sooner rather than later. Recently passed tax laws may throw a curveball into the financial planning strategies you’ve set in motion with your advisors. Here are six tips to help you and your attorney, CPA, and financial advisor evaluate whether […]

Three clients. Three solutions. One common theme.

We’ve rounded the corner into the fourth quarter! As the calendar year draws to a close, you’re likely well aware that charitable giving is not only crucial to your clients first and foremost as an act of generosity, but also as a powerful tool in tax planning. Consider the following hypothetical client situations: You want […]

Inherited IRAs: A charitable solution?

Remember the good old days when your clients could withdraw the money they inherited in their parents’ IRAs over the course of their lifetimes, thereby deferring the income tax for as long as possible? This so-called “stretch IRA” was largely eliminated by the SECURE Act of 2019, which requires most non-spouse beneficiaries to withdraw the […]

National Estate Planning Week

For many attorneys, financial advisors, and CPAs, estate planning is part of your client conversations every single month, week, and day of the year. You never hesitate to remind clients to update their wills, trusts, and financial plans as their circumstances change. Even though you remind your clients regularly about the importance of having an […]

Lean on us: Five reasons to call the FM Area Foundation

In an economic and legislative environment full of unpredictability, we encourage you to tap the knowledgeable team at the FM Area Foundation–perhaps even more than you have in the past. If you’ve already established a donor-advised or other type of fund at the FM Area Foundation, you’re familiar with many of the ways we make charitable […]

Navigating new laws: Opportunities for 2025

It’s more important than ever to stay informed about how changes in the tax law may affect your charitable giving. The recently-passed One Big Beautiful Bill Act (OBBBA) creates challenges as well as opportunities for structuring your philanthropy. We encourage you to reach out to your attorney, CPA, and financial advisor to evaluate how the […]