Fall Professional Advisors Education and Social Event, featuring Bryan Clontz, Charitable Solutions

Featured Speaker: Bryan Clontz Bryan is the founder and President of Charitable Solutions, LLC, specializing in non-cash asset receipt and liquidation, gift annuity reinsurance brokerage, gift annuity risk management consulting, emergency assistance funds, as well as business, virtual currency, and life insurance appraisals/audits. He also serves as Senior Partner of Ekstrom Alley Clontz, a community […]

Gifts of artwork: Worth a look, but be careful

If you’ve noticed a surprising uptick in recent years among your younger clients investing in artwork, it is not your imagination! A survey of 1,007 U.S. high net worth individuals (each with at least $3 million in investable assets) found that 83% of respondents aged 43 and under said they currently own or would like to […]

Quiet types: Spotting clients who prefer to give anonymously

At the FM Area Foundation, we’re dedicated to helping your clients achieve their charitable goals. We’re honored to serve as your trusted resource for tax-efficient giving strategies, allowing your clients to maximize their charitable impact and support them as they build lasting philanthropic legacies. As you continue (or begin) conversations about charitable giving with your […]

Timing is everything: Mapping out clients’ 2025 charitable giving plans

It’s never been easy to navigate the ever-shifting tax rules to help clients structure charitable gifts, and now it’s even trickier. Major changes under the One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, are creating complexity, opportunity, and, for some, urgency. The OBBBA reshapes both how much a client can […]

“It’s so easy”: How the FM Area Foundation makes giving such a pleasure

As individuals, families, and businesses get more involved in charitable giving, it’s not uncommon to become overwhelmed with all the options for supporting favorite charities. Plus, it can be hard to know what really makes a difference. The FM Area Foundation is here to help make charitable giving easy, flexible, and effective. Our team loves […]

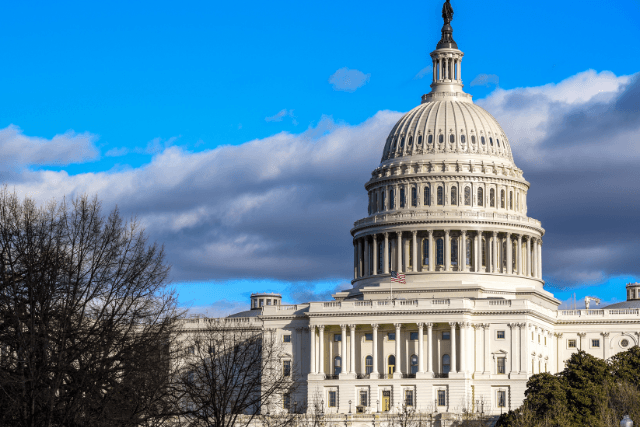

One Big Beautiful Bill Act: Three Insights for Philanthropy

The One Big Beautiful Bill Act was signed into law by President Trump on July 4, 2025, after the House of Representatives approved the Senate’s changes to H.R. 1, which passed the House by a narrow margin in May. The OBBBA, with nearly 900 pages of provisions, reshapes policy across major sectors of the U.S. […]

Easier than you might think: Moving a donor-advised fund to the community foundation

As you advise clients on charitable giving, you’re likely aware of the growing popularity of the donor-advised fund as a flexible, tax-efficient tool for philanthropy. Many families appreciate how donor-advised funds can streamline giving, foster family engagement, and serve as a launchpad for deeper community impact. Recently, we’ve engaged with many professional advisors—attorneys, accountants, and […]

Donating business interests: Why a fund at the community foundation is the ideal recipient

If your client base includes business owners, you probably weren’t surprised by this observation in a recent Wall Street Journal article about the “stealthy wealthy”: “Behind a paycheck, the largest source of income for the 1% highest earners in the U.S. isn’t being a partner at an investment bank or launching a one-in-a-million tech startup. […]

More questions than answers: Pending tax legislation

There’s little doubt that you’ve seen extensive news coverage of the so-called “Big Beautiful Bill” (H.R. 1) that passed the House of Representatives by a 215-214 vote on May 22, 2025, and now moves to the Senate, where significant changes are expected before final passage. And that is the primary takeaway here: Significant changes are […]

QCDs: Soon there may be more to love

If you are 70 ½ and older, by now you’ve likely heard about a charitable giving tool called a Qualified Charitable Distribution (“QCD”), allowing you to direct a distribution from your IRA to an eligible charity, such as a designated fund, unrestricted fund, or field-of-interest fund at the FM Area Foundation. With a 2025 limit […]