Research shows many people want their advisors to raise the issue of philanthropy; however, it can be uncomfortable knowing when to bring the subject up. Here are some scenarios when it might make sense to talk about charitable giving.

You know that including a charitable provision in your client’s estate plan provides tax advantages and can also help establish a permanent legacy. Your client’s bequest can create a fund that will forever contribute to the causes that matter to them.

Your client may wish to share some good fortune with the community at year’s end but doesn’t have the time to decide how. You could recommend a donor-advised fund at the FM Area Foundation, providing an immediate tax deduction while buying time to decide on the most effective use of charitable assets later.

A client with highly appreciated stock who is considering a charitable gift can receive a tax deduction for total market value while avoiding capital gains tax that would arise from a typical stock sale.

If your client isn’t receiving sufficient income from appreciated assets, a charitable remainder trust could assist them in achieving charitable objectives while preparing them well for retirement.

The community foundation can help evaluate the most beneficial asset distribution to minimize taxes. It is usually more tax advantageous to donate retirement assets to charity and leave other assets to heirs. Income and real estate taxes often dilute the value of an IRA left to an heir.

Suppose your client owns highly appreciated stock in a company that is about to be sold. In that case, the community foundation can suggest several ways to structure a charitable gift to help your client reduce capital gains tax and maximize the impact to a charitable cause.

When a client doesn’t have the resources required to start a private foundation or lacks time to oversee it, we can help you and your client consider more straightforward and cost-efficient alternatives, such as a donor-advised fund or supporting organization.

Still not sure if you’re completely comfortable discussing this topic? We’d be happy to accompany you when meeting with your client. Contact Lexi Oestreich at 701.234.0756 or lexi@areafoundation.org.

You have the power to make a positive impact in two ways. You can donate to one of our 500 existing funds, or you can contact us to create a charitable fund that matches your values. Whichever route you choose, we are humbled by your trust and grateful for your kindness and generosity.

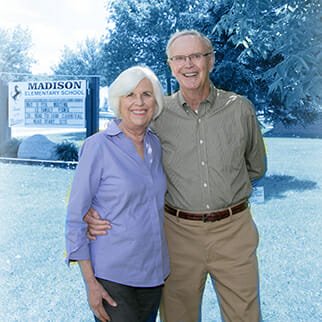

“We wanted the scholarship to live on as a legacy for Norman and I in our communities to encourage a young person as they seek their dreams.”

“Serving on the Foundation board enables me to support efforts to strengthen our community.”

“We are thrilled to engage our daughters as future advisors to our fund. Knowing there will always be a family member to guide our charitable intent makes us feel great.”

“Anything that can motivate a child’s love of reading deserves support. Read to Lead can be such a vehicle.”

“Thank you to the Women's Fund for supporting our moms and children.”

“The community foundation is specifically created to encourage and nourish the giving spirit in the community.”

“Thanks to support from the FM Area Foundation, we completed two major projects. We're very grateful for the Foundation’s generosity as these projects support our mission to preserve and maintain the historic facility.”

“Support through the FM Area Foundation and its supporters has created an immeasurable impact on our work — delivering hope and fostering a sense of belonging for so many in our community going through a tender time in life. This ripple of kindness is cultivating joy and shared connection in our community, just because, and only made possible through generous donors. What a beautiful gift to know your community cares about you!”